Risk markets were spooked overnight by forecast US GDP figures just as tonight’s latest PCE print is predicted to come in hotter than expected. The twin whammy of low growth and higher inflation did not help stocks on Wall Street which fell back for the first time in three sessions, with European issues also volatile. The USD moved higher initially but came back lower later in the session with the Australian dollar remaining firm above the 65 cent level.

10 year Treasury yields were up several points, bursting through the 4.6% level, while oil prices also gained with Brent crude lifting above the $89USD per barrel level on a strong bid. Meanwhile gold was unable to make any great strides, still struggling from last week’s setback to remain stuck at the $2330USD per ounce level.

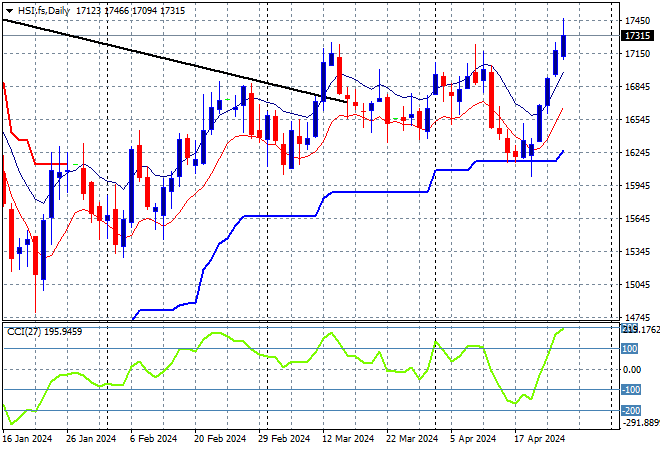

Looking at markets from yesterday’s session in Asia, where mainland and offshore Chinese share markets lifted together in modest fashion with the Shanghai Composite up nearly 0.3% while the Hang Seng Index has gained nearly 0.5% to close at 17284 points to continue its own strong start to the trading week.

The Hang Seng Index daily chart was starting to look more optimistic with price action bunching up at the 16000 point level before breaking out in the previous session as it tried to make a run for the end of 2023 highs at 17000 points with the downtrend line broken. However this has been thwarted so far at the monthly resistance levels, although support at the 16400 point area is the area to watch next as price bounces off:

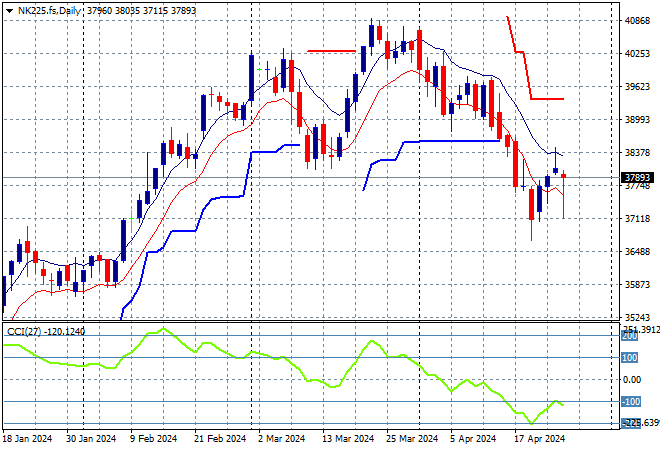

Japanese stock markets however retraced solidly with Nikkei 225 slumping more than 2% lower to finish at 37628 points as traders await the BOJ decision today.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Short term resistance has been defended with short term price action now retracing to support at the 39000 point level. Watch the 38000 level for signs of a true breakdown although futures are looking quite mixed:

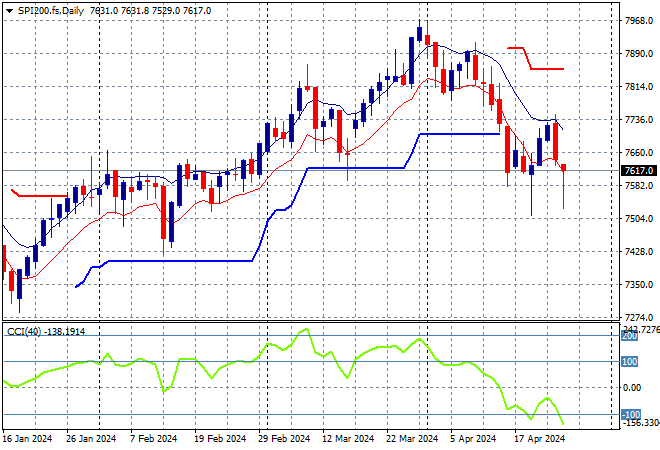

Australian stocks were closed for ANZAC Day.

SPI futures are down at least 0.3% somewhat in line with the falls on Wall Street overnight. The daily chart was looking firmer with the medium term uptrend and short term price action coming together to take out the previous December highs. ATR daily support has now been broken, which is significant, taking price action back to the February support levels, although momentum is failing to get out of its oversold condition:

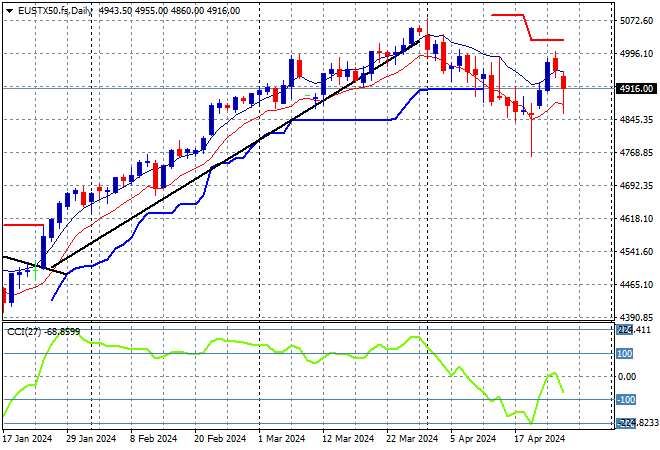

European markets were unable to continue their own rebound with some solid down sessions across the continent as the Eurostoxx 50 Index finished 1% lower at 4939 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout but this retracement below short term support could turn into a larger reversal with a clear break of support at the 4900 point level that is trying to be filled here. Is this a dead cat bounce though:

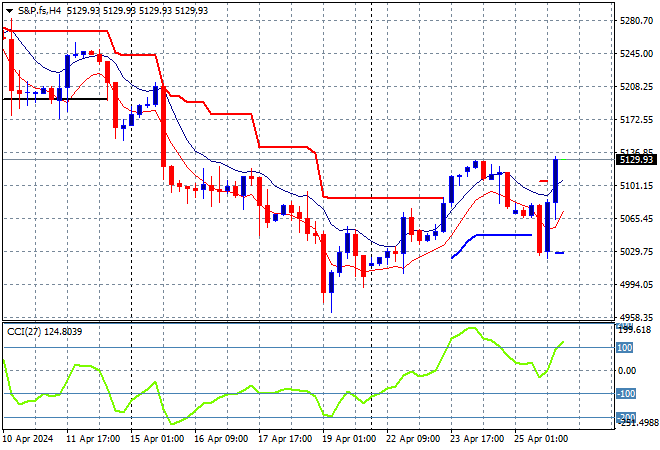

Wall Street was down sharply initially on the GDP figures with only a very late bounce saving some grace, with the NASDAQ off more than 0.6% while the S&P500 finished just 0.5% lower, closing at 5048 points.

The daily chart previously showed a consolidation that could have turned into a proper reversal here as price action broke below short term support as momentum became somewhat oversold. As I said previously, this break below the 5240 point area has setup for further downside. Firm support at 5000 points has turned into a proper pause here with a breakout above four hourly ATR resistance at the 5100 point level still not sure although futures are indicating a fill tonight:

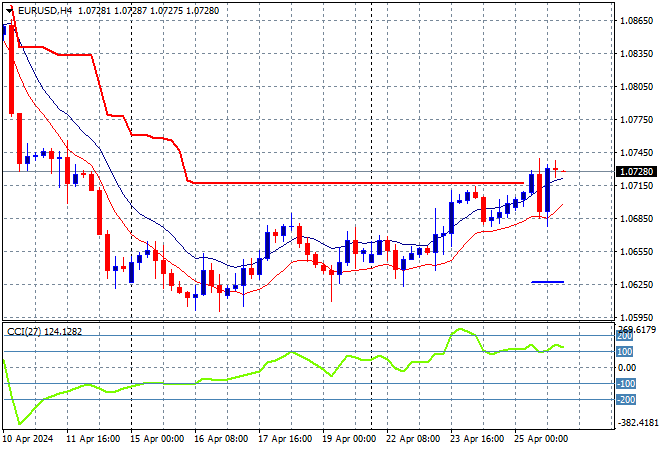

Currency markets have been slowing turning away from King Dollar and had a mild reversal on the GDP and PCE double whammy before getting back on track with Euro holding above the 1.07 handle overnight, nearly completing a rounding bottom pattern on the four hourly chart below.

The union currency had previously bottomed out at the 1.07 level at the start of April as medium term price action with a reprieving reversal in price action back towards the 1.09 level before last week’s inflation print. Short term support at the 1.0740 has been rejected so watch that level closely:

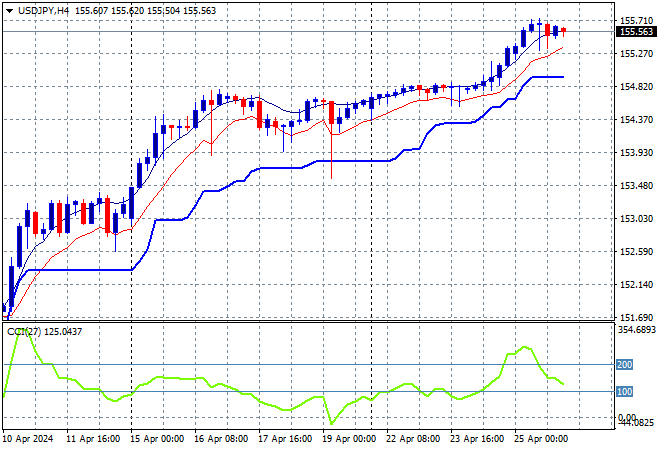

The USDJPY pair has been piling on breakout after breakout, managing to push aside the 154 handle at the start of last week and now able to break above the 155 level overnight with a near constant runup in preparation for today’s BOJ meeting.

The medium term picture was always somewhat optimistic as Yen sold off due to BOJ meanderings but momentum had been building before the CPI print, positive for all of the last week at least with ATR support upgraded throughout. This is likely overcooked in the short term but sets up for potential gains from here:

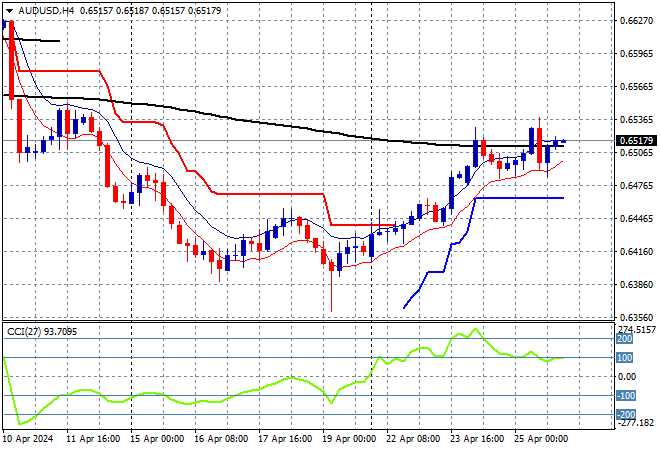

The Australian dollar remains above the 65 handle with a small breakout thwarted overnight but still sitting optimistically at its two week high.

The Aussie has been under medium and long term pressure for sometime before the RBA and Fed meetings and while the previous temporary surge looked strong, it wasn’t overbought on the four hourly chart and had not surpassed support from last week’s consolidation phase. Watch as this rounding bottom pattern is now complete as momentum builds for another attempt at the 65 cent level:

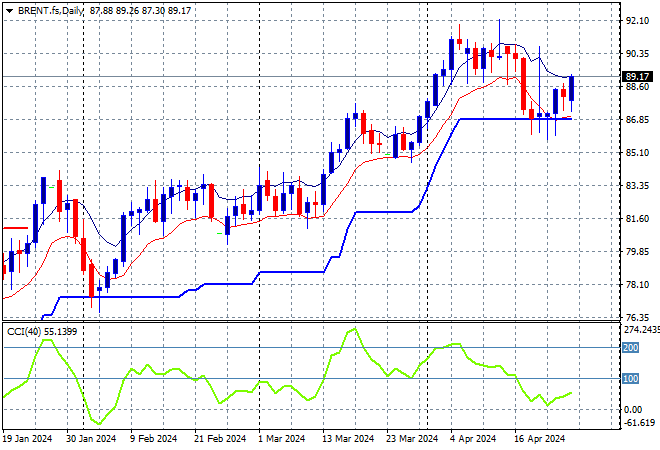

Oil markets has seen increasing intrasession volatility after topping out during the latest round of Middle East conflicts with moves to the downside thwarted as Brent crude lifted above the $89USD per barrel level in a much stronger session overnight.

After breaking out above the $83 level last month, price action has stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Watch daily ATR here carefully:

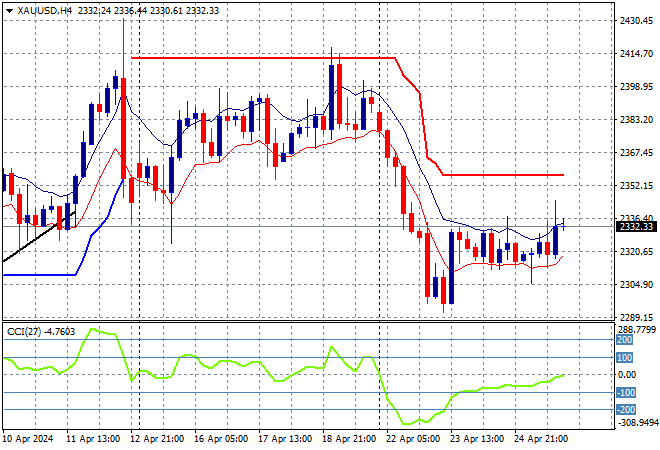

Gold is still trying to get back on trend after the minor retracement back earlier in the month with the failed breakout above the $2400USD per ounce level turning into a correction as it remained stuck at the $2330 level overnight.

Support at the $2200 level is still a long way off here as shorter term support at the $2330 area needs to be defended first or the early April gains will also disappear promptly:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!