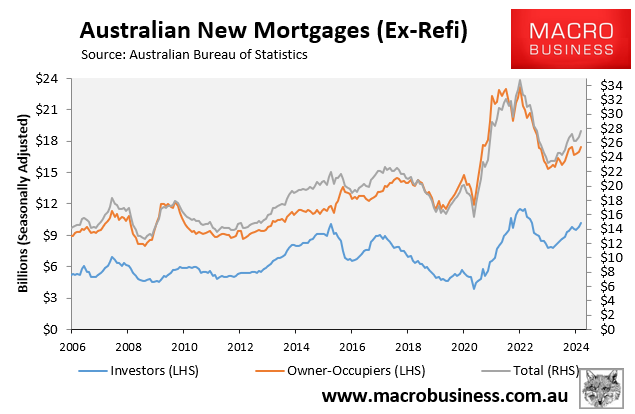

The latest mortgage finance data from the Australian Bureau of Statistics (ABS), released on Friday, debunked the notion that Australia’s property market is suffering an investor “exodus”.

The value of investor mortgage commitments increased by 31.1% in the year to March. This easily outpaced the 11.4% growth that owner-occupiers reported.

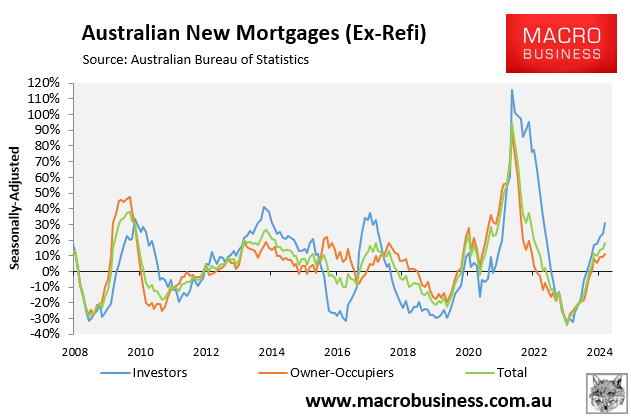

The following chart shows the strong rebound in investor mortgage growth more clearly:

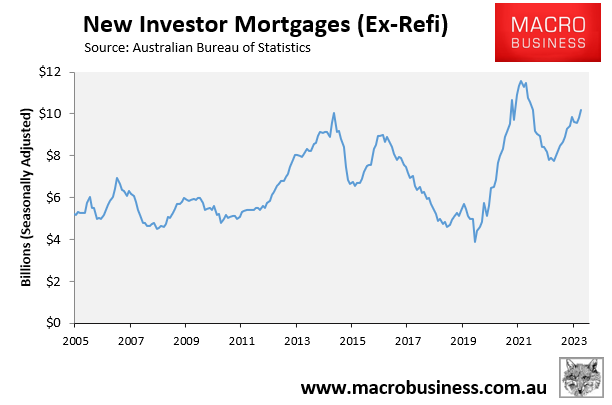

Investor mortgage demand continues to outstrip demand from first-time buyers (FHBs).

In March 2024, investor mortgages totalled $10.2 billion, while FHB mortgages totalled $5.2 billion.

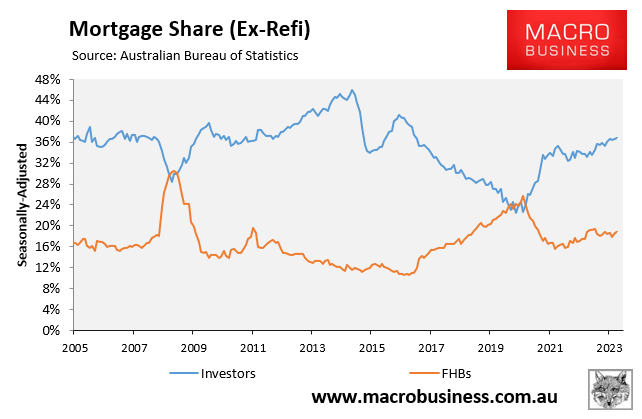

The chart below shows the inverse link between investor mortgages and FHB mortgages, indicating that investors are squeezing out FHBs:

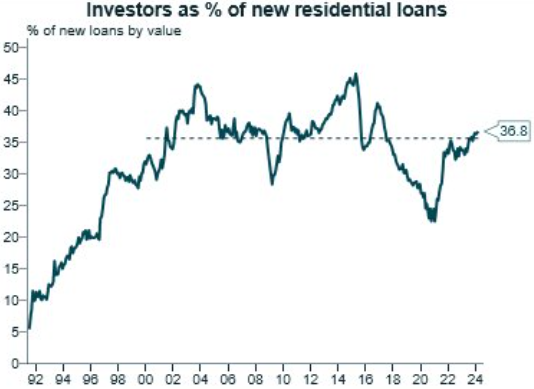

The proportion of mortgages flowing to investors has drifted above the century average, at 36.8%:

Source: Alex Joiner (IFM Investors)

The average loan size for investors has climbed to an astounding $635,700, surpassing all other cohorts of purchasers:

Source: Alex Joiner (IFM Investors)

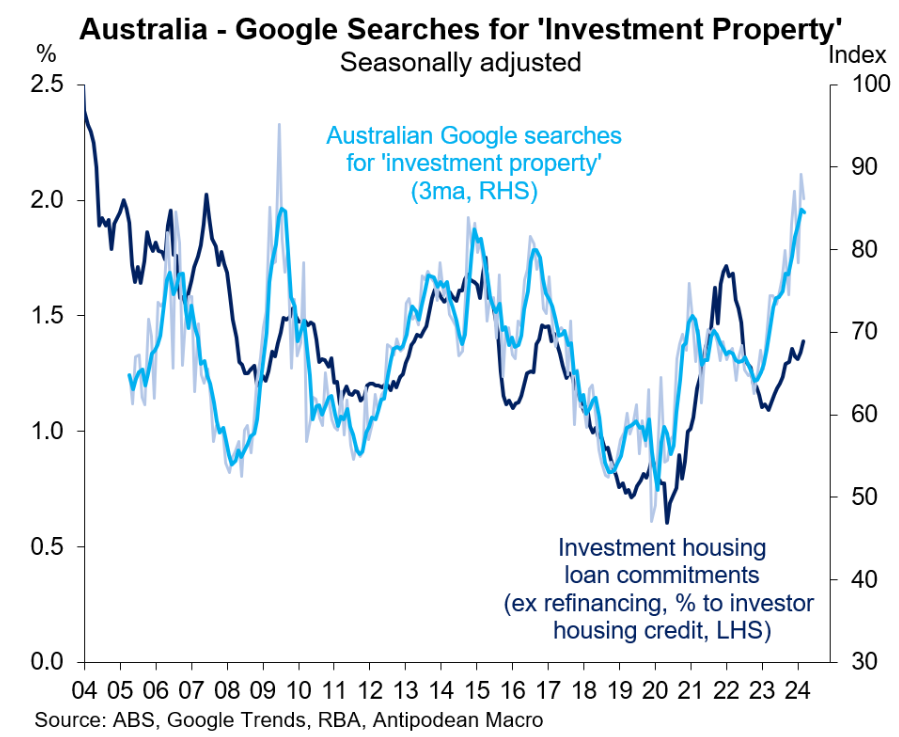

Finally, Australian Google searches for “investment property” have risen to record levels on a three-month moving average basis:

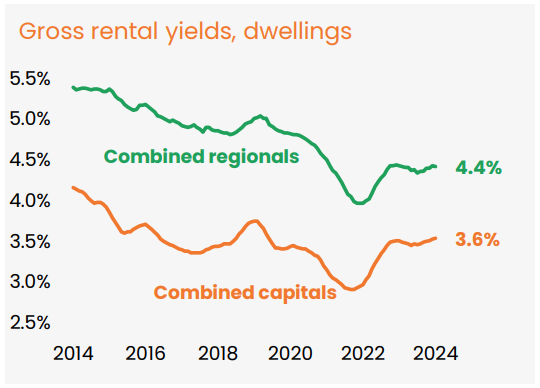

The increased interest from investors makes sense given that rental growth exceeds prices, lifting yields:

Source: CoreLogic

“National rents have been rising at a faster pace than values since November last year, supporting a rise in gross rental yields”, CoreLogic noted in its April housing market report.

“In April, the national gross rental yield rose to 3.75%, the highest reading since October 2019, up from a record low of 3.16% in January 2021”.

With the Reserve Bank expected to begin a monetary easing cycle later this year or early next, and rents expected to continue to rising at a strong pace amid historically high net overseas migration, it is not surprising that investors are piling back into the property market.