At last, MB is not alone in telling the truth.

It began earlier this week with the nation’s leading macro team, led by the excellent Gareth Aird at CBA. when he wrote:

…incredibly strong net overseas immigration has put upward pressure on some components of the CPI basket. This has made the RBA’s task of returning inflation to target more difficult.

As is typical of the economic fraternity, honesty follows a brave soul sticking his head up and then an army piles in, this time behind Mr Aird to condemn Albonomics at the source:

“I don’t think it’s helpful to be adding to demand in any form to an economy where there is already excess demand in both goods and the labour market,” said Su-Lin Ong, chief economist Australia for RBC Capital Markets.

More:

Andrew Ticehurst, a senior economist and rate strategist at Nomura, said policymakers needed to be “more strategic”.

“If we have people coming into the country, but the experience is more clogged roads, and homes they can’t afford to buy, then the increase in immigration won’t be sustainable over the long term,” Mr Tichehurst added.

More:

UBS economist George Tharenou is calling for an even more radical stance.

“Unless there’s a material policy change, population growth is likely to continue to surprise on the upside,” he warned.

More:

The US is also facing strong population growth, but unlike Australia, it is not expected to boost inflation because both rental costs and wages growth in the world’s largest economy peaked last year.

US population growth is what Australia used to be. We sensibly took in many migrants when we had a structural labour shortage (as the US does now) during the mining boom on either side of the GFC mining investment boom.

However, since that boom went bust in 2012, we have kept bringing in people for its own sake. Effectively switching from a capital investment economic model to a labour market expansion model that shallows the capital stock and kills productivity.

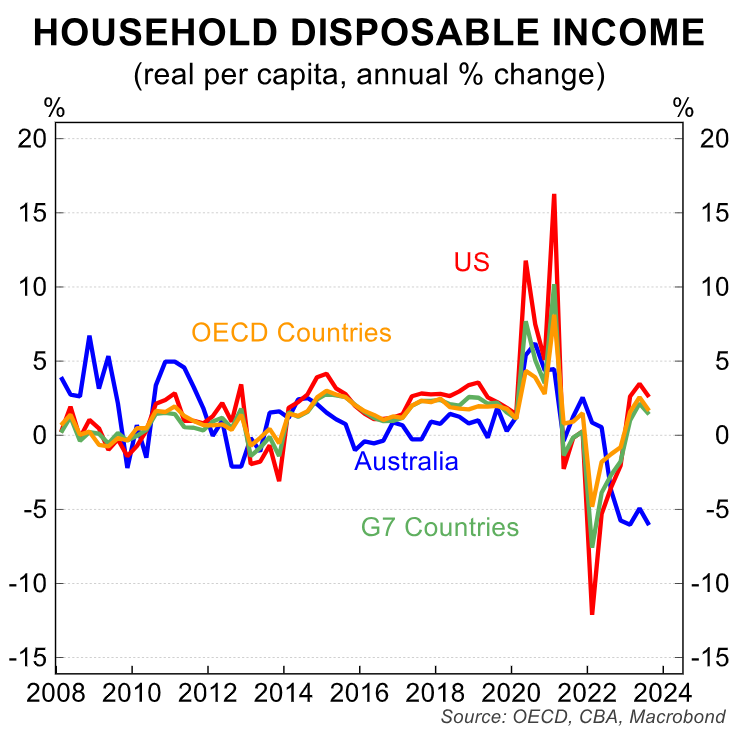

All this has done has delivered fake GDP for pollies to trumpet while living standards per capita fall because productive assets are being clogged to the gills.

The media won’t cover it because they are a relative winner via real estate assets, the last of their growth options.

Thank god the economic community is finally waking up to it because if it continues Australians will get poorer for as long as it lasts.

More here for those patriots that are interested: