The National Bank of Canada has released a new report describing the collapse in Canadian living standards in relation to the United States:

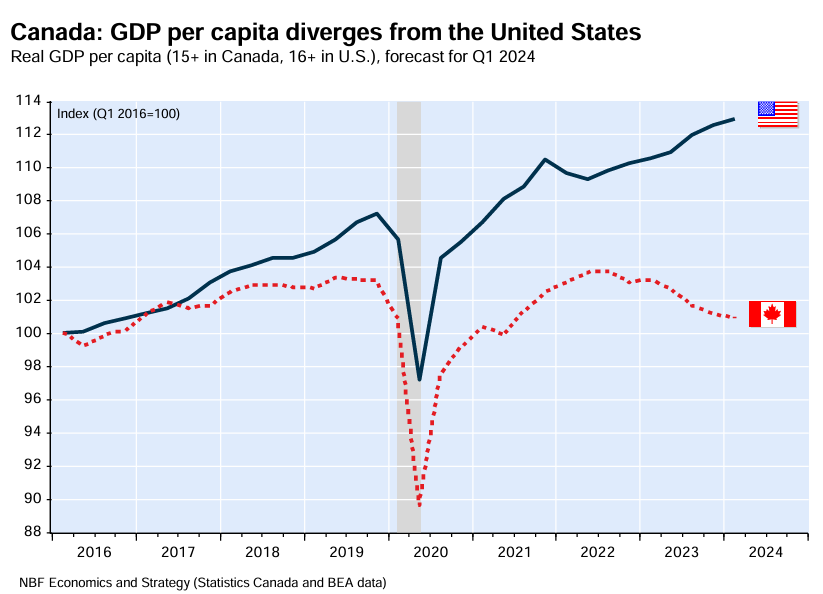

“[Canada’s] population aged 15 and over rose by a record 3.5% in the first quarter, making a positive contribution not only to GDP, but also to potential output”.

“As a result, GDP per capita is set to fall further in Q1, continuing the downward trend that began when interest rates began to rise. This shows that the economy has been operating well below potential for some time now”.

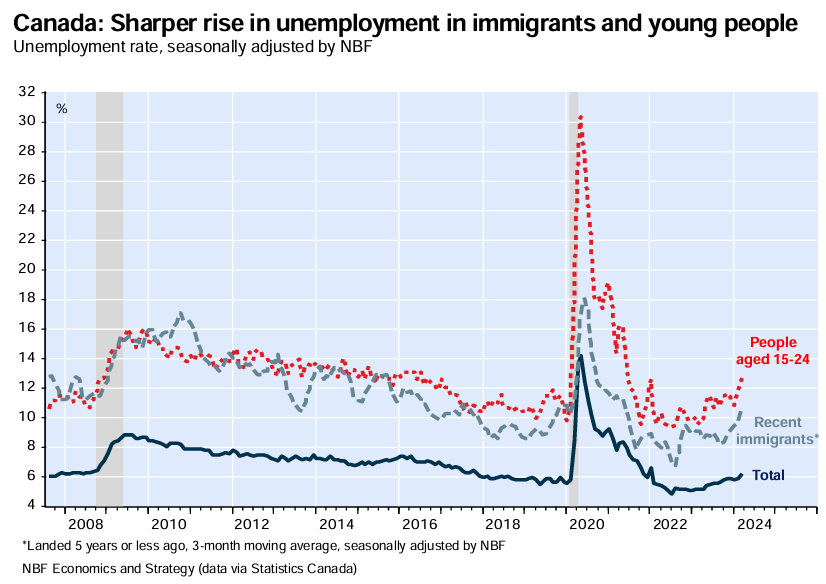

“Canada’s economic weakness is also reflected in the rapidly slackening labor market. Hiring is no longer keeping pace with population growth, and the weakness has been particularly glaring in the private sector since mid-2023”.

“The unemployment rate now stands at 6.1%, an increase of 1.3 percentage points since the start of monetary tightening, with young people and immigrants hardest hit by this deterioration”.

“Unemployment among 15-24 year-olds has risen by 3.3 percentage points since the start of monetary tightening, the sharpest rise ever seen outside a recession”.

“As for recent immigrants (those who arrived 5 years ago or less), their unemployment rate has risen by 3.6 points since its low point in 2022”.

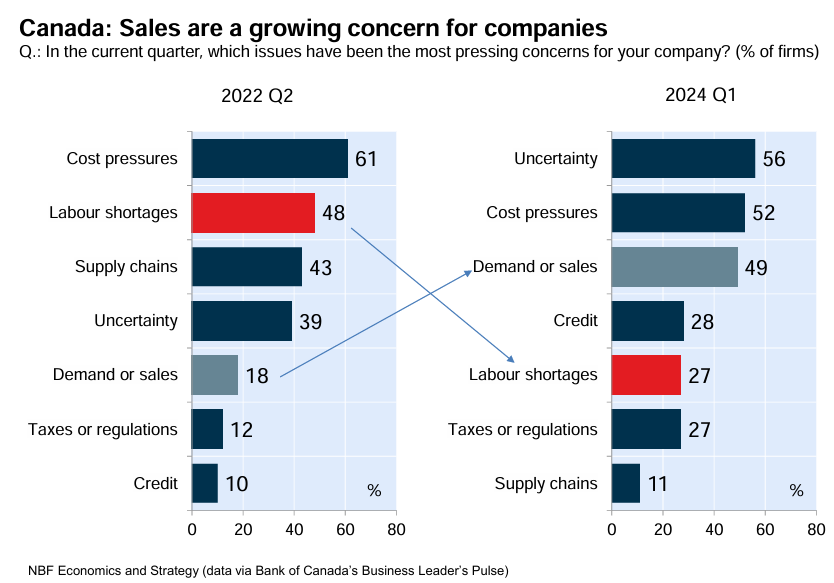

“Since the tightening of monetary policy, the proportion of companies facing labor shortages has fallen dramatically (from 48% to 27%). On the other hand, almost half of companies are concerned about customer demand in the current climate of uncertainty (18% in Q2 2022)”.

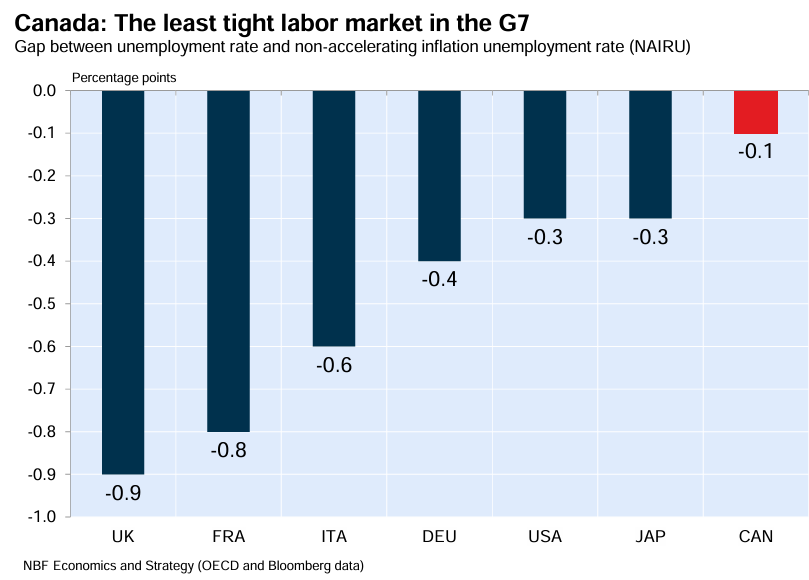

“Canada’s labor market has eased considerably in comparison with other advanced countries. According to the OECD, the inflation adjusted unemployment rate (NAIRU) stands at 6.2%, barely above the 6.1% unemployment rate recorded in March”.

“All other G7 countries are currently showing a greater gap between their unemployment rates and their NAIRU, meaning tighter labor markets”.

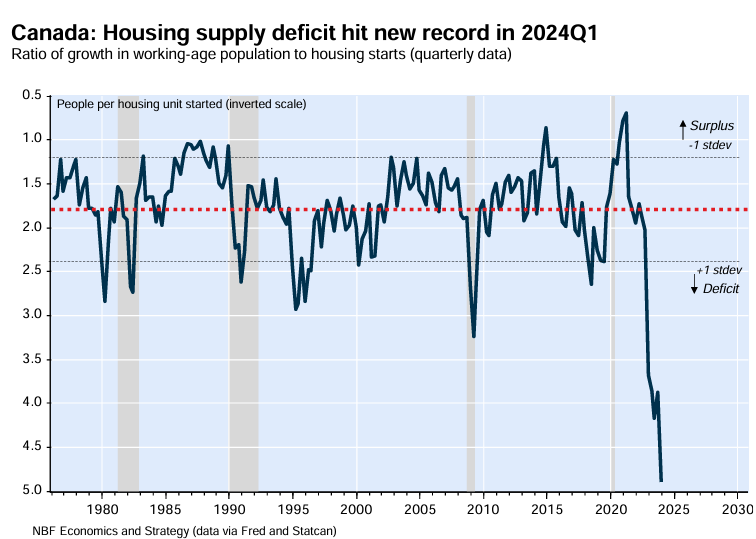

Separate analysis from the National Bank of Canada showed that the nation’s housing shortage has hit an all-time high after the working-age population grew by 300,000 during the most recent quarter (at an annualised rate of 3.7%), compared to housing starts of only 61,000 in the first quarter of 2024:

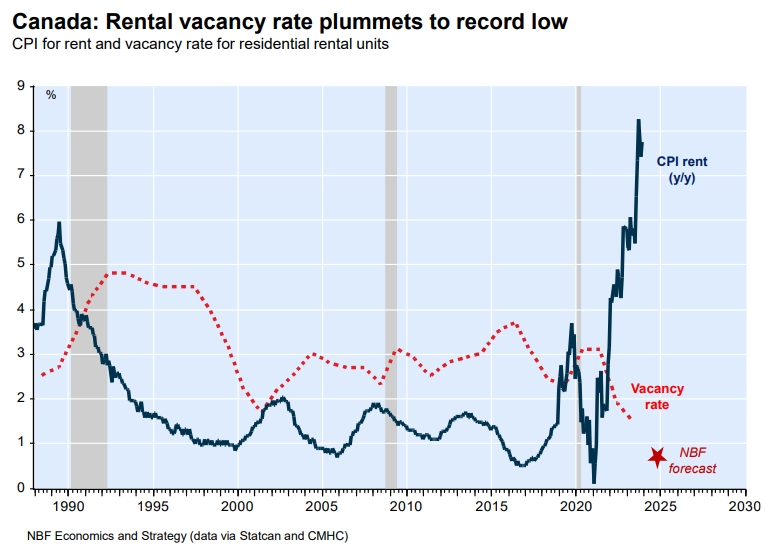

The unprecedented surge in population demand has sent rental vacancy rates to all-time lows and rental inflation to the moon:

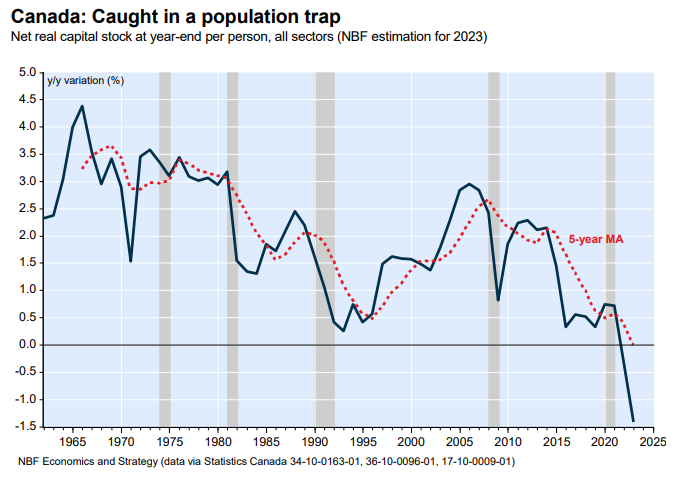

Meanwhile, Canada’s productivity growth has collapsed as the growth in population has surpassed the expansion of business investment, housing and infrastructure, resulting in capital shallowing:

“Demographic ambitions are too high relative to the stock of capital available in the country. According to our calculations, Canada’s capital stock per capita collapsed close to 1.5% in 2023”, wrote National Bank of Canada economists earlier this year.

“This means that our population is growing so fast that we do not have enough savings to stabilize our capital-labour ratio and achieve an increase in GDP per capita”.

“Simply put, Canada is in a population trap for the first time in modern history. More worrisome is the fact that the decline is not simply due to a lack of housing infrastructure”.

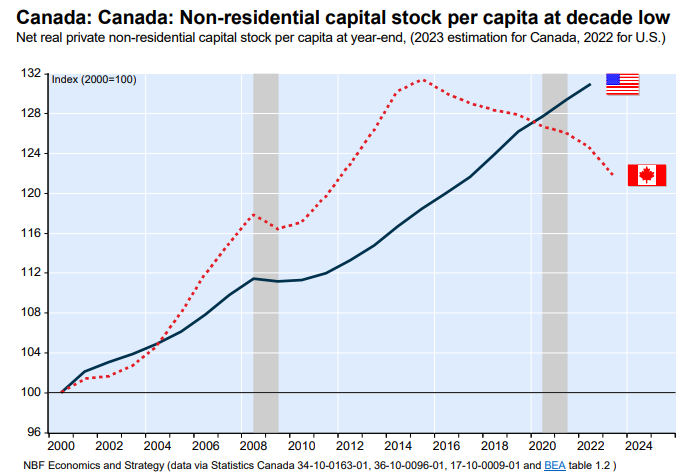

“In fact, the private non-residential capital stock to population ratio has been declining for seven years and is currently no higher than it was in 2012, while it is at a record high in the U.S”.

“Canada is caught in a population trap that has historically been the preserve of emerging economies. We currently lack the infrastructure and capital stock in this country to adequately absorb current population growth and improve our standard of living”.

“Our policymakers should set Canada’s population goals against the constraint of our capital stock, which goes beyond the supply of housing, if we are to improve our productivity”, the economists recommended.

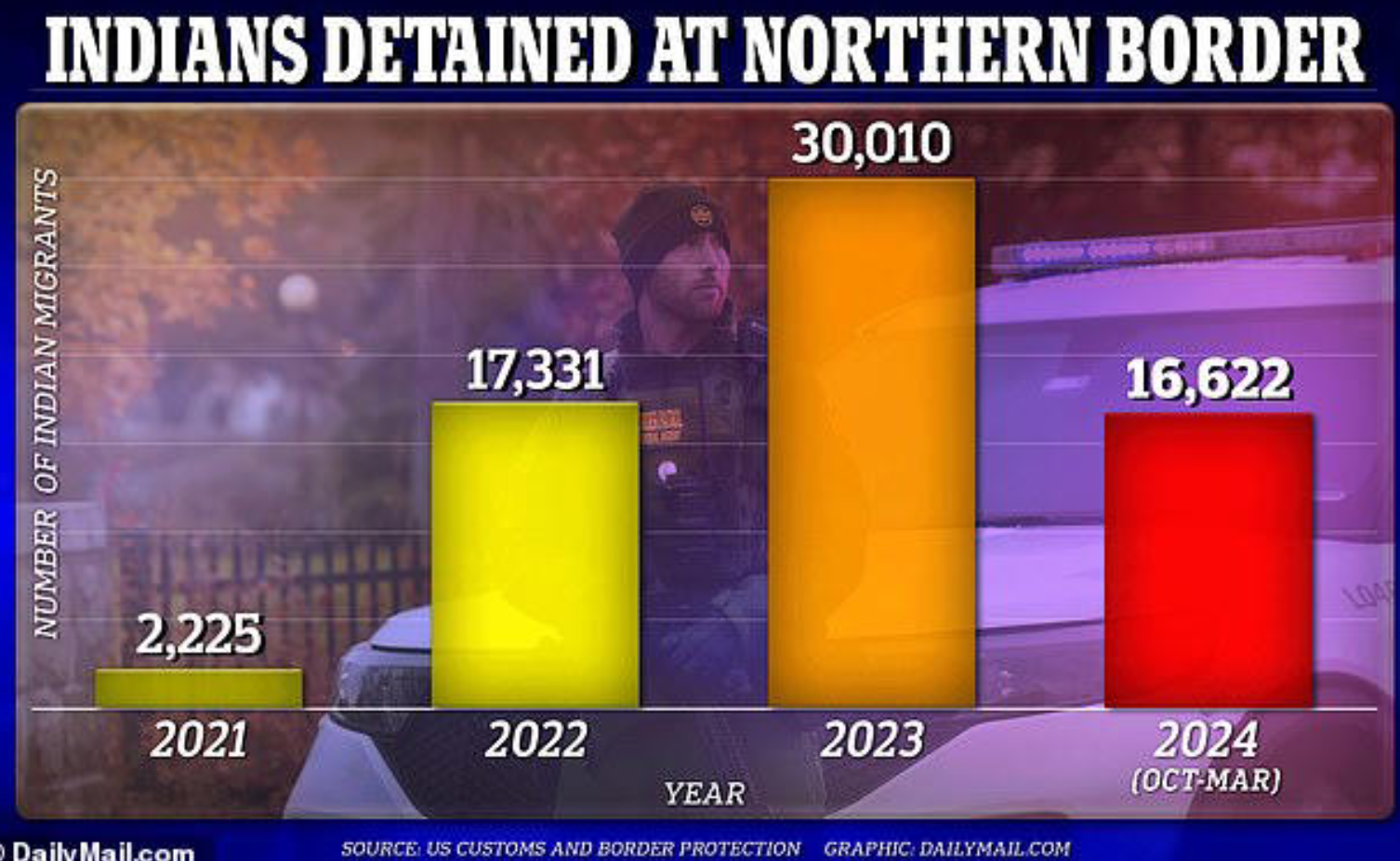

The situation is now so bad that Indian migrants are now leaving Canada for the United States:

“There were 30,010 Indian nationals apprehended at the norther border in 2023. A further 16,622 have also arrived this fiscal year, which began on October 1”.

“Indians are now the third-largest group of undocumented migrants in America”.

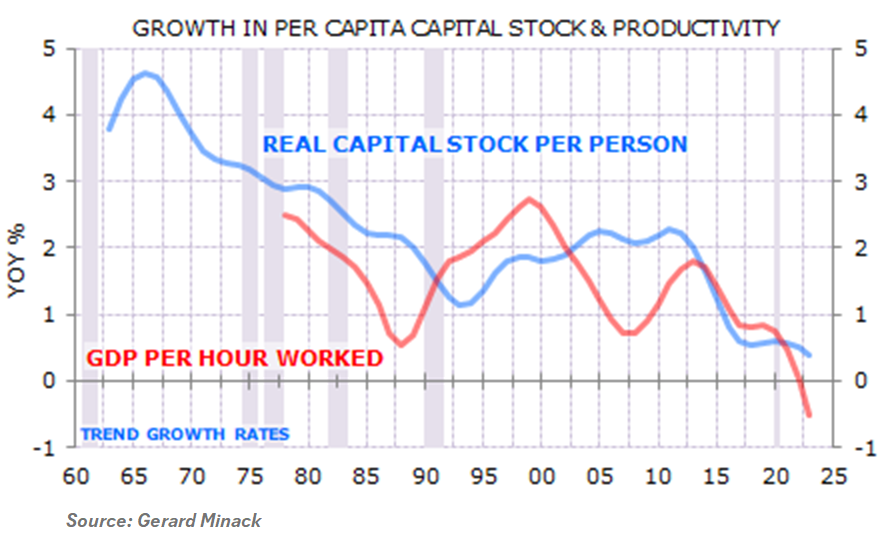

Similar forces are in play in Australia, which is also experiencing record net overseas migration, collapsing productivity growth, a worsening rental crisis, and plummeting living standards.

“Australia’s economic performance in the decade before the pandemic was, on many measures, the worst in 60 years”, Independent economist Gerard Minack wrote in his November report.

“Per capita GDP growth was low, productivity growth tepid, real wages were stagnant, and housing increasingly unaffordable”.

“There were many reasons for the mess, but the most important was a giant capital-to-labour switch: Australia relied on increasing labour supply, rather than increasing investment, to drive growth”.

“Australia’s population-led growth model was a demonstrable failure in the 15 years prior to the pandemic”.

“Remarkably, the country now seems to be doubling down on the same strategy. The result, unsurprisingly, is likely to be more of the same”, Minack wrote.

Canada and Australia are facing an Argentinian-style future if they continue to pursue the same broken, low-productivity, population-driven economic model.